Why mid cap stocks might be a better option for your portfolio than small cap allocations

By Montag & Caldwell

June 5, 2020

Many investors have included small cap allocations in their portfolios due to the strong performance track record over long periods of time and the diversification potential of a relatively inefficient asset class. As we know, however, there is no free lunch when it comes to investing. Small caps historical strength comes with greater risk than other equity asset classes in terms of return volatility, which may at times, adversely impact an investor’s total portfolio return.

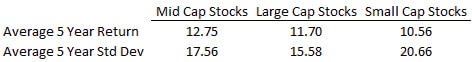

One way to examine the risk-return trade-off is to look at rolling return periods. Rolling returns can be a better proxy for an investors’ actual holding period and might also include both up and down market environments. The following table is sourced from the Russell Indices and begins on December 31, 1978 and ends March 31, 2020. There are 146 total five-year return periods. (Mid cap, large cap, and small cap stocks are represented by the Russell Midcap Index, Russell 1000 Index, and Russell 2000 Index, respectively. Indices represent unmanaged stocks grouped by market capitalization and/or style as a means to measure performance and characteristics.)

Compared to small cap stocks, large cap stock returns have been, on average, 11% higher with 25% less volatility (The standard deviation, “std dev,” is a measure of dispersion, or volatility, of a set of data from its mean, measuring the absolute variability of a distribution.) Mid cap stock returns have been, on average, 21% higher with 15% less volatility. Investors should be demanding higher returns for the increased risk of owning small cap stocks.

While there are certainly opportunities to trade around small cap stocks — assuming you have the skill to get in and out of the asset class at the right time, a permanent allocation to your portfolio mix of mid cap stocks could be a better alternative to small cap stocks as a source of risk-adjusted returns.

Mid cap stocks represent the sweet spot of the market capitalization spectrum, offering greater stability and safety compared to small cap stocks, and superior growth potential relative to more mature large cap stocks. Typically, mid cap companies have exited the early, high-risk stage of their life cycle and have entered a period of steadier, perhaps even faster, growth.

Relative to small cap, mid cap companies have already achieved a certain level of success establishing their business models. They also tend to be on more secure financial footing, generating superior free cash flows that can be used to support growth — either through reinvestment in the business or through acquisition. They also have less trouble accessing credit markets for needed capital. Stronger balance sheets and cash flow support this asset class in market downturns, allowing them to not only survive, but thrive as they emerge from such periods in stronger competitive positions compared to smaller, weaker rivals. They outperform small caps during periods of economic contraction and heightened risk aversion and outperform large cap during expansionary periods characterized by greater risk taking.

Mid cap stocks have often been overlooked or underused in portfolios, crowded out by large and small cap allocations. Replacing a discrete small cap allocation with mid cap can simplify your overall portfolio construction and reduce risk without sacrificing upside return potential.

Montag & Caldwell is committed to producing superior investment results for our clients. Learn more.

Montag & Caldwell, LLC was founded in Atlanta, Georgia in 1945 and has served both private clients and institutional investors for 75 years. While primarily known for managing equity securities, our firm’s experience also includes fixed income and asset allocation strategies – with an emphasis on managing risk.